Tabla de contenido

[zoomsounds id=”is-the-self-employed-needed-to-have-an-online-store”]

Disclaimer:

This guide is not legal advice and by using it, you agree to this disclaimer. The content provided is for informational purposes only and is not considered advertising, solicitation or legal advice. It is advisable that you consult an independent legal adviser before using this model contract. You should read the information carefully and modify, delete or add any and all areas as necessary. The use, access or transmission of said content and information or any of the links mentioned in this document is not intended to create, and the receipt of this does not constitute an attorney-client relationship between WeLoveWeb and you or any other user. You should not rely on this information for any purpose without first seeking legal advice from an attorney licensed in your city or province. The information it contains is provided for general information only and may or may not be useful to you in your current situation or reflect the latest legal developments; therefore, the information is not promised or guaranteed to be correct or complete. WeLoveWeb expressly disclaims all liability with respect to any action taken or not taken in reliance on any or all of the contents of this agreement. Furthermore, WeLoveWeb does not necessarily endorse or take responsibility for third-party content that may be accessed through this information.

Before we start with this informative blog, let’s start with the main thing, what is freelance?

According to Social Security it says such that:

“For the purposes of this Special Regime, self-employed or self-employed workers will be understood as those who habitually, personally and directly carry out an economic activity for profit, without being subject to a work contract and even if they use the paid service of other people, whether or not they are the owner of an individual or family business”

For more information please visit the social security website.

So the big question would be:

Would we need to register in the Self-Employed Regime to be able to sell online?

If you have an economic income from your online company, you know that the different public administrations will want their part of the business and you have to pay attention and know what the legal implications are that are related to your business.

The Treasury will want its corresponding percentage of each sale you make, and for its part , the social security will seek your registration as self-employed so that you pay your corresponding fee each month

According to what social security says:

“Registration as self-employed is mandatory for any person over 18 years of age who habitually, personally and directly carries out an economic activity for profit and is not subject to an employment contract.”

And so? How can we know that we have an activity on a regular basis?

We could say that for Social Security our activity is continuous since having an online store actually gives you the opportunity to have sales 24 hours a day, every day of the week, and have more regularity than even a physical store. Therefore, and from this point of view, it would be considered that your sales activity would be habitual.

Having an online store is a good way to get some extra money, or to be able to live from it.

It’s always depending on how much time you give your project.

And many people ask themselves a typical question that seems to have an easy answer, although in reality it is more complicated than it seems.

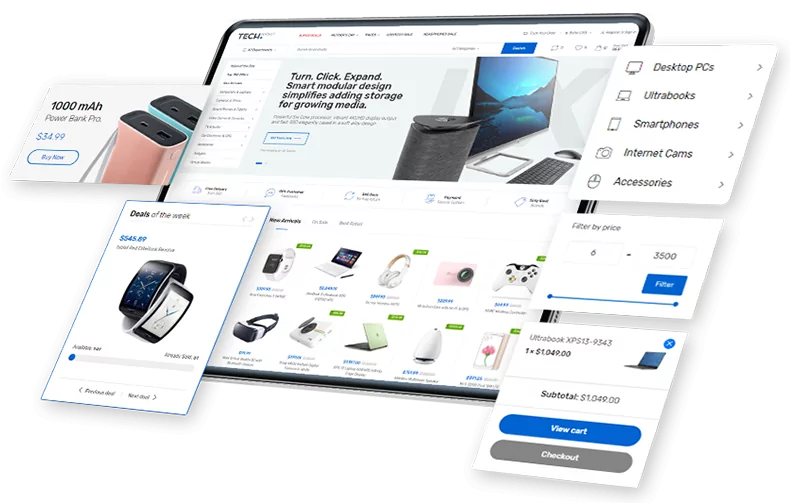

Online Store that sells!

Do you need a redesign or a new website for selling online?

Complete solution for retail and wholesale. Great UX/UI designers, experienced programmers and high emphasis on testing. If you are looking for a professional partner for your business in the online world, contact us!

What will we pay as a freelancer if we have an online store?

To have an online store and have a certain economic activity, we would have to register as self-employed not only in the Treasury to be able to invoice, but also in Social Security.

In any case, as a self-employed person, as a natural person, owner of an online business, we must pay the Personal Income Tax (IRPF) and the value added tax (VAT).

Can we have problems if we do not register with social security?

If we start to have our sales online and on top of that we are not registered with Social Security or the Treasury, the consequences, let’s say, would be:

- Immediate obligation to register in the RETA . (Special Regime for Self-Employed Workers)

- Pay the self-employed fees in arrears with the surcharge established by Law 6/2017 of October 24. This surcharge varies between 10 and 35% depending on whether the payment of overdue fees is voluntary or if we have received notification from Social Security forcing us to do so.

So be especially careful with this issue, and find out as much as possible with a lawyer or accountant before starting your online business.

Therefore, and to make everything a little clearer, the only way to start without being autonomous would be these two conditions:

- That the economic activity is not habitual.

- That the activity does not generate income of more than €950 gross monthly minimum wage (€13,300 per year) in 2021

How do I register as self-employed?

We can register as freelancers ourselves, or you can also hire the services of an agency.

It is another way of doing things and you also make sure that all the procedures are done correctly.

In the event that you want to do it yourself, the first thing you should do is register with social security.

It should be done before the start of the activity, and then register with the Treasury.

To do this, you must fill out a document called model 037. It is not complicated to fill it out, but keep in mind that you must read it very carefully and fill it out correctly, it will depend on whether you will pay more or less taxes and what your tax obligations will be.

Once you submit form 037 to the Tax Agency, you will be able to invoice. You must submit a VAT return on a quarterly basis, which is model 303, and make a payment on account of the benefits, which would be model 130. You would also have to do the annual VAT summary, in this case we would use model 390.