[zoomsounds id=”must-have-online-payment-gateways-in-europe-en”]

Which are the three most commonly used payment gateways for online stores in Europe, and why do you need to have them on your website?

Online shopping in Europe and the UK today is a hassle-free experience due to the many payment options people can access.

But here’s the question: how do you decide on which one suits you? And more importantly, which of the most used payment gateway options in Europe are best for online stores?

A Staple of Today’s Business Model.

Adding a cash transfer gateway is the most crucial step in setting up an online business or website. Choosing one should be a matter of serious consideration. Otherwise, you’re looking at not one but two worst-case scenarios:

- You skipped this step, and your customers are let down by the difficulties of being unable to pay you.

- You made the wrong payment portal choice, given your business’s specifics. This can lead to late deliveries, hidden fees, risky transactions, and customer dissatisfaction.

Fortunately, European businesses have a great deal of help setting up a working system. Even with several transfer options, they can explore the one right for them.

Online services like WeLoveWeb offer much-needed assistance in creating your E-commerce site. However, this can include but might not be limited to:

- Website personalization.

- Mobile-friendly features.

- Automated service.

- Secure and convenient payment gateways.

The last one is where preferences in European markets can differ completely. So, before we get into much detail, let’s see what the people are using.

A Look at The Facts.

Among the several methods used for online shopping in Europe, some of the most popular include:

- E-wallets (PayPal, Stripe, etc.)

- Banking services like Mastercard, Visa, and domestic cards.

- Others (Vouchers, bank transfers, cash on delivery, etc.)

Nearly half of online transfers in the mainland and the United Kingdom are done through PayPal and similar services. But some methods are more favored than others, depending on the country.

For example, apart from the UK, most people in Croatia, Spain, Portugal, and Germany also prefer digital services. But in Switzerland, France, and Latvia, around half the internet shopping is done through Visa or Mastercard.

In eastern countries like Hungary and Romania, most people opt for cash-on-delivery (COD) in eastern countries like Hungary and Romania. Some nations have their preferred domestic methods. The Dutch service iDeal, for example, is used by more than 80% of e-shoppers in the Netherlands, while half of Germans prefer GiroPay.

In any case, methods like COD and invoice transfers have their benefits. However, E-commerce stores must have payment gateways to maximize overall user convenience.

What Makes A Good Payment Gateway?

The diversity of payment options generally revolves around personal preferences and which ones work best. But we can deduce that the choices above are the leading payment gateways in Europe.

The popularity of a particular transfer method depends on its efficiency, convenience, and reliability. But these are merely the basics. To satisfy modern needs, there are a few features that payment gateways must-have.

No Georestrictions.

Shopping via the internet allows users in one country to purchase goods and services from another. Moreover, this is an increasing trend that businesses need to focus on.

Different payment methods might operate differently in different nations. You need one that is just as easy to use in-country as it is for international transfers. However, this includes continent-wide functionality and efficient currency exchange.

Uniform Service Standards.

Customers can visit any number of online stores for their spending. Many of them use the same or related payment merchants for accepting money.

Users that prefer a single system often experience inconsistencies when visiting different websites. However, this is mostly due to an issue at the end of the payment service provider.

Therefore, online services that facilitate monetary exchange should have a uniform integration system.

Quick Response.

The entire premise of online shopping is based on remote and speedy transactions. Third-party providers often fail to process payments quickly, taking days before notifying updated customers.

That is unacceptable. Top-notch transfer services should authorize payment entries quickly without relying on an intermediary.

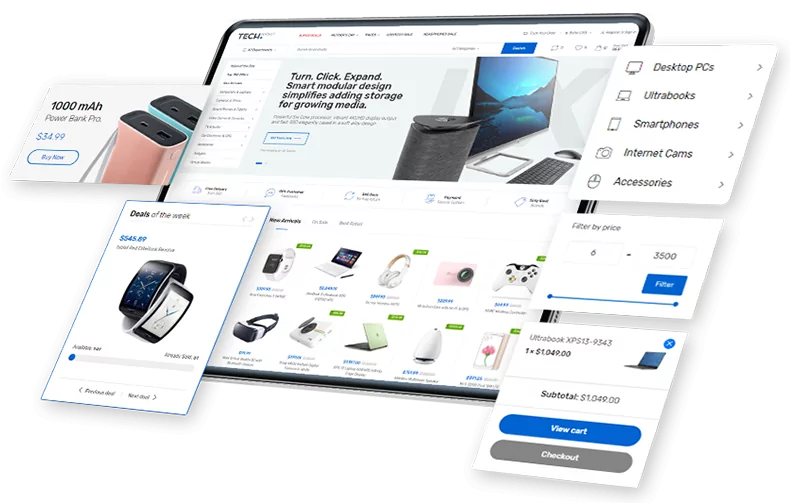

Online Store that sells!

Do you need a redesign or a new website for selling online?

Complete solution for retail and wholesale. Great UX/UI designers, experienced programmers and high emphasis on testing. If you are looking for a professional partner for your business in the online world, contact us!

Application or Programming Interfaces.

APIs allow digital service providers to offer their assistance through specially designed developer systems. However, this is excellent for competing in large markets and giving each unique customer various options.

However, getting an API to work in your business’s favor isn’t the easiest undertaking. Luckily, third-party agencies can help you in this area while you run your business.

Sensible Service Rates.

Service charges are a mainstay of every good transfer service. That is how they keep themselves in business and offer their assistance to others.

But there’s a limit to what should be considered a reasonable commission rate to charge. Particularly for small businesses or individuals, there should be a range of affordable packages.

Additionally, keeping all charges transparent is vital. Payment gateway providers must limit hidden charges and unsustainable interest rates in their fee structure.

Secure Transactions.

Some of the most well-known and successful cash transfer methods owe their popularity to their safe business dealings. Many providers only work with SSL-encrypted websites for maximum protection.

Credit card fraud is a widespread issue. Hence, competent service providers have optimized their dealings to safeguard their clients and ensure that doesn’t happen.

Top 3 Online Payment Gateways in Europe.

We’ve already discussed which of the main money transfer methods are most commonly used across Europe. Their popularity is usually due to remarkable ease, safe transactions, and reputable service.

We’ve also learned that different places have different overall favorites. However, this might be due to the various discrepancies between service providers’ various discrepancies in their packages.

First PayPal – The Crowd Favorite.

Since its founding, PayPal has established itself as a juggernaut among E-commerce ventures. Available in the EU and Britain, as well as over 200 other nations and counting, its ubiquity is unmatched.

Pros.

Reputation.

Having been around since the internet, PayPal is noted for its market stability and renowned status. People often avoid online transactions due to security fears or other reasons. But PayPal’s service model has been attractive to businesses and customers everywhere. And as we’ll discuss, it’s for a good reason.

Ease of Use.

PayPal’s mobile app is one of the quickest and most user-friendly on the market. Plus, it makes international transactions much easier than most alternatives.

Easy Integration.

Adding PayPal’s transaction portal is incredibly quick, easy, and free for all businesses, even with minimal skills. Moreover, this makes it a compatible, readily available choice for all e-commerce applications.

Security

With PayPal, users come for ease of use but stay for financial stability. Its highly secure and protected payment system is why longtime and new users are confident in PayPal.

Plus, clients can even enjoy refunds in the unlikely event of transfer fraud.

Cons.

Cost of Service.

One objective drawback of PayPal is the charges. For business owners, commissions starting at 4% below a monthly 2500€ and 2.4% for invoices no less than 50000€ is not the best deal.

A free version is available, but the relative lack of features makes the whole experience much less enjoyable.

Off-site Payment.

Rather than authorize payment on the store website, users must be redirected to the PayPal app. While this might seem like a good security feature, it adds hassle to the whole experience.

Lack of 24/7 Support. PayPal usually responds well with refunds to complaints, but if they come through on time. Their business hours-only support services sometimes make it difficult for clients to get a timely reply. However, this often leads to further complications if the response is too late.

Second Stripe – A Worthy Opponent.

With an estimated share of almost one-fifth of the global market, Stripe is PayPal’s top competitor. Over 170000 websites are believed to be using its services for processing payments.

Despite being a more recent player, Stripe nonetheless has many tools and features at its disposal. These include interface customization, mobile service, customer support, and security.

Pros.

Expediency.

Quite a few features that Stripe brings to the table make for a more enjoyable and efficient experience. For instance, it allows customers to remain on the store website when making checkout payments.

Another handy feature is its 24/7 live support, which enables quick responses to complaints.

Great Value.

Stripe’s service model is particularly suited to small and medium-sized businesses. That is thanks to much lower transaction fees, API support, and an extremely easy and quick setup structure for websites. The rates for European and non-European cardholders are also fairly low.

Advanced Features.

The secret to Stripe’s competitive status lies in its numerous nifty and advanced features and utilities. This diverse service package ensures a unique and valuable position in the market.

Cons.

Skill Requirements.

Features like customizable user interface capabilities and API integration are great… if you know how to use them. But without technical skills, those can be difficult to get right.

Without an instruction manual, your e-store might need assistance from third-party developers. And while that’s an affordable option, that’s not many, thanks to Stripe.

Support.

Despite providing a complaint support system, Stripe employs an e-mail-only system. However, this doesn’t necessarily restrict customer expression, but there’s room for improvement.

Reach.

A few European markets like Croatia, Belarus, Georgia, and some small territories currently don’t enjoy Stripe’s service.

Plus, Stripe relies more on the third-party model than PayPal. However, this can cause payment processing to take longer.

Third Bank-based Payment Gateway Providers.

If your business has been running for a while, and you have demonstrable results and the required turnover you can use the most cost-effective and one of the most secure payment gateway options. Namely through your bank.

Pros.

Convenience and Versatility.

They accept virtually any credit card from any bank.

Users are familiar with these payment gateways (for example RedSys in Spain) and trust them more.

Rates.

We can safely say that a bank payment gateway is one of the safest options for making payments over the Internet.

Security

Very high level of security than other solutions.

Cons

Fewer Facilities.

While they provide great basic service, bank payment gateways offers usually fewer features than E-wallets. However, this isn’t a deal-breaker but the fact that they’re second to PayPal in European markets is largely due to this.

Complicated Setup

Integrating banking gateways into your store website is much more complicated than PayPal. However, this, too, isn’t a major hindrance. E-commerce and web development services can be hired to solve this issue at a reasonable price.

Conditional Service

With bank-based payment gateway, businesses are usually obligated to provide a certain minimum turnover for the previous period. Without that, they cannot qualify for a payment gateway.

For that reason, start-ups and small-scale stores might benefit from choosing PayPal or Stripe instead

Market Confidence

As this solution is provided directly by banking houses, their security and trust is usually very high.

Bottom Line

Payment gateways in Europe are available in many forms and countless services. Upon comparing them, you’ll find they have their specialties, advantages, and drawbacks. However, what if you were asked to choose only one?

That right there is where you need to view things a bit differently. As we have already discussed, having a transfer portal for your online store is a no-brainer. And since not all businesses can afford to build their own, using existing ones should be the way to go.

But instead of selecting just one service, the better approach is to integrate as many payments gateway providers to your site. However, this allows a company to cover all its bases effectively. So, combining both would be wise if you find that one service has cheaper rates, but the other has more international reach.

For most companies and online business owners in Europe, integrating a payment gateway to their website is not hard. But if you need to make informed decisions, e-commerce and web design solutions through online services can help greatly.

In Closing

Providing patrons with an easy-to-use payment system is a must for all European e-businesses and websites. But instead of being perplexed on which is better, you need to realize that each has its pros and cons.

Just have as many of the top payment gateways in Europe added to your store to maximize your online business prospects.

This is both for the possibility of accepting the widest possible range of payment options and, above all, for the convenience of your users, who will always find the payment option they prefer.